World Business Angels Investment Forum (WBAF) announced key-findings of a global survey that included business owners from more than 81 countries including the European Union Countries (EU) and across multiple industries. WBAF, an affiliated partner of the G20 Global Partnership for Financial Inclusion (GPFI), has submitted comprehensive policy recommendations to the G20 leadership in order to alert policymakers about the urgent needs of startups, as revealed by the survey.

Angel Investor Review interviewed with WBAF’s Grand Assembly members representing EU countries, on the current state of the European entrepreneurship and investment ecosystem after pandemic.

(London) The world is on the verge of a great disruption sparked by the COVID-19 pandemic. For the first time since the Great Depression of 1929, every country, every society and every economy in the world has seen the impact on health, employment, finance, trade and business. Every report we see—from the World Bank, IMF, OECD, WEF, and NASDAQ—forecasts wide-ranging effects of this great disruption.

The World Business Angels Investment Forum (WBAF) conducted a global survey that included business owners from more than 81 countries and across multiple industries. It elicited opinions on issues in a variety of domains, ranging from financing, the workforce, business model realignment, and types of support that are needed during this turbulent economic period.

The key findings of our May 2020 WBAF survey can be summarized as follows:

• 52.22% expected their funds would last 3-6 months without any additional funding; 29.6% of respondents reported that their current funds would last more than 3 months.

• 41.1% of respondents reported a > 50% drop in market demand for their services or products.

• 63.1% of startups surveyed plan to change their business model in the post-pandemic business cycle; 36.1% of respondents have definite plans to pivot their business during this business cycle.

• 46.5% of respondents believe that the impact of the pandemic will last 6 months to a year; 11.3% believe it will persist beyond 2 years.

• 39.90% of respondents reported a drop in the valuation of their business, but 21.67% reported an increase.

• Funding, demand, and workforce represent 37.93% of the challenges startups face, with funding ranking highest.

Angel Investor Review interviewed with WBAF’s High Commissioners, Senators and International Partners representing EU countries in the Grand Assembly.

Yulia Stark, WBAF’s Belgium Senator & President European Women Association says ‘’ Belgian corporations and entrepreneurs have been taking a beating since the coronavirus crisis began. A survey of 4,725 corporations located in Belgium, reveals that four out of ten firms surveyed report a drop in sales by over 75%. In addition, 50% of firms are reporting liquidity issues. Firm size is definitely a decisive factor, with small and medium-sized enterprises more heavily affected by the current crisis, partly because they are more exposed to the closure imposed by the Belgian government.

Yulia Stark, WBAF’s Belgium Senator & President European Women Association says ‘’ Belgian corporations and entrepreneurs have been taking a beating since the coronavirus crisis began. A survey of 4,725 corporations located in Belgium, reveals that four out of ten firms surveyed report a drop in sales by over 75%. In addition, 50% of firms are reporting liquidity issues. Firm size is definitely a decisive factor, with small and medium-sized enterprises more heavily affected by the current crisis, partly because they are more exposed to the closure imposed by the Belgian government.

However, investors that have placed their trust in scale-ups have barely changed their investment strategies in light of COVID-19. Deloitte’s latest survey, supported by Scale-Ups.eu, on the impact of COVID-19 on scale-ups focuses on the investor perspective. In May this year, seven out of ten Belgian scale-ups stated they remain confident that their business will successfully navigate the COVID-19 pandemic. However, investors believe that they were slightly too optimistic. While companies have primarily focused on cost restructuring and augmenting their overall market-readiness, pivoting business models is not a course of action recommended by the investors.

Belgian companies experiencing financial difficulties due to the COVID-19 outbreak can apply for extended social security and tax support measures– e.g. faster access to temporary unemployment, bridging benefits for the self-employed, suspension of mortgage payments for households hit by the crisis, bank loans guaranteed by the federal government and regional support for affected companies –but these may prove insufficient to safeguard the economy’s production potential in the acute phase of the crisis.

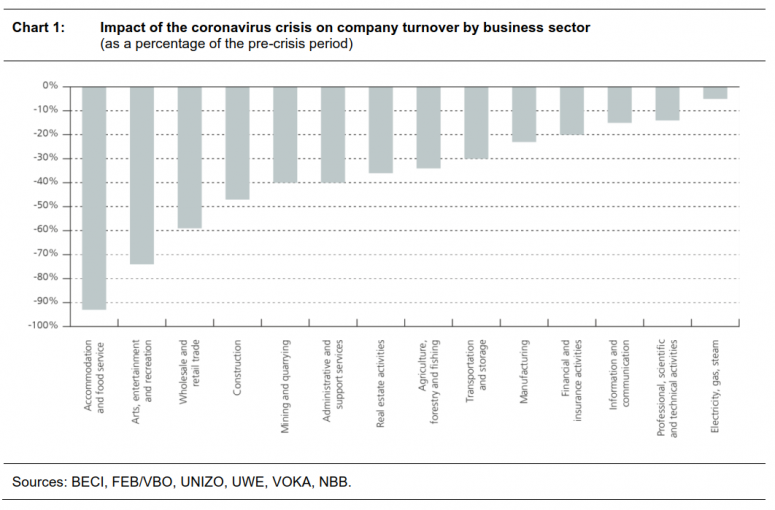

Chart 1: Impact of the coronavirus crisis on company turnover by business sector (as a percentage of the pre-crisis period) This year, economic activity in Belgium is down by 9 % as a result of the restrictions imposed to prevent the spread of the Covid-19 pandemic. As these restrictions are eased, the economy should gradually recover. Sources: KPMG, BECI, FEB/VBO, UNIZO, UWE, VOKA, NBB.

Chart 1: Impact of the coronavirus crisis on company turnover by business sector (as a percentage of the pre-crisis period) This year, economic activity in Belgium is down by 9 % as a result of the restrictions imposed to prevent the spread of the Covid-19 pandemic. As these restrictions are eased, the economy should gradually recover. Sources: KPMG, BECI, FEB/VBO, UNIZO, UWE, VOKA, NBB.

Želiko Kolar, Chairman of the Board of Directors, WBAF Croatia Country Office & Krapina Zagorje County Governor says ‘’The method of fighting the pandemic in Croatia proved to be very effective in the first wave, and at the international level, Croatia was recognized as successful for crisis management. In less than two months, the disasters reunited the stakeholders of Croatian society, aroused social sensitivity and brought a general positive spirit among the population.

Želiko Kolar, Chairman of the Board of Directors, WBAF Croatia Country Office & Krapina Zagorje County Governor says ‘’The method of fighting the pandemic in Croatia proved to be very effective in the first wave, and at the international level, Croatia was recognized as successful for crisis management. In less than two months, the disasters reunited the stakeholders of Croatian society, aroused social sensitivity and brought a general positive spirit among the population.

In addition to pandemic measures, Croatia has also adopted a number of economic measures. Already in March, 66 measures were adopted to help the economy, most of which related to preserving the liquidity of companies and jobs of entrepreneurs. Furthermore, a second package of measures was adopted for the economy in April, and enforcements were stopped during the crisis. Two new financial instruments “COVID-19 loan” and “Micro loan for rural development” were introduced. The Croatian government is engaged in securing significant funds from EU funds in the EU budget for the next seven-year financial period.

The greatest needs of entrepreneurs are focused on maintaining liquidity, and currently there aren′t sufficient funds available for financing current liquidity as liquidity financing measures for micro and small enterprises have been suspended. It is necessary to provide additional financial resources for financing current operations and for short-term liabilities to the state and other short-term liabilities.

It is now more than ever clear that the diversification of the Croatian economy is a necessity, digitalization at all levels is an unavoidable process that opens up great potential for growth and development, preserved nature as well as rich history and beauty of the site resources for development of the smart tourism, and the agile and entrepreneurship friendly eco-system is the first condition for achieving the desired growth and sustainable development.

Krapina-Zagorje County, as the seat of the WBAF office in Croatia, showed by its example how active measures to support the startup system and entrepreneurs create new opportunities. Since the beginning of 2020, WBAF Croatia has identified new business angels who want to invest their knowledge and resources in sustainable entrepreneurial ventures. At the same time, in the first incubator established in the region, the first accelerator program in Croatia was implemented, based on the cooperation between WBAF Croatia and the Estonian accelerator Startup Wise Guys. A network of experienced mentors was established who invested more than 300 hours mentoring 10 teams in the program, which resulted in our team winning the startup competition at the international investment conference in Slovenia in the competition of 140 selected startups. The Office also used the investment opportunity from EU funds for the establishment of the first fund for business angels intended for investments in socially responsible companies in cooperation with the European Fund for Business Angels. Continuous cooperation with the first Croatian VC fund – Feelsgood Capital Partners in the creating of a platform for additional development of alternative capital sources, indicates that Croatia has room for additional support for start-up entrepreneurs.’’

Alexandra Lund, WBAF’s Cyprus Senator & Founder & CEO, Core Values says ‘’ Having been hit by the second financial crisis in less than 10 years, Cyprus businesses are forced to adjust to the New Normal quickly. However, although the pandemic has set certain markets back drastically, it has also generated the right conditions for other markets to take a giant leap forward. Entrepreneurs who are quicker to read the changing consumer behaviour will take a more active and profitable role in the post-pandemic business environment. Hence, new, exciting and profitable products and services can be created, facilitating stabilisation of the economy.”

Alexandra Lund, WBAF’s Cyprus Senator & Founder & CEO, Core Values says ‘’ Having been hit by the second financial crisis in less than 10 years, Cyprus businesses are forced to adjust to the New Normal quickly. However, although the pandemic has set certain markets back drastically, it has also generated the right conditions for other markets to take a giant leap forward. Entrepreneurs who are quicker to read the changing consumer behaviour will take a more active and profitable role in the post-pandemic business environment. Hence, new, exciting and profitable products and services can be created, facilitating stabilisation of the economy.”

Dimitrios Matsakis, WBAF’s International Partner for Greece & Partner of the P.L.A.N, Greece says ‘’ When Greek startups like Blueground show the door to 25% of their workforce, this may certainly be considered very unpleasant, though expected. Every single team in the tourism, leisure, and transport sectors has to proceed to a dramatic review of its growth plans.

Dimitrios Matsakis, WBAF’s International Partner for Greece & Partner of the P.L.A.N, Greece says ‘’ When Greek startups like Blueground show the door to 25% of their workforce, this may certainly be considered very unpleasant, though expected. Every single team in the tourism, leisure, and transport sectors has to proceed to a dramatic review of its growth plans.

Perhaps the only European country in a continuous state of crisis over the last ten years, Greece and its economy have had to and are still facing the covid-19 challenge; the country has reacted in an exemplary manner from the Health and population safety perspective. The so far slow but steady economic recovery –after a one-year-long expected recession, is likely to accelerate through public investment, big projects and infrastructure development and overall modernization, whereas the pandemic appears unlikely to have a major impact on the expected development plans.

“Ta panta rei” (generally translated as: everything flows), is a famous quote from ancient Greece. And when looking for contexts where this may be true, it is very hard not to think of entrepreneurship. Circumstances such as those we are currently experiencing are the stuff which makes existing teams stronger, and also which drives focused, obsessed and ambitious teams to rise. Startups are the product of creative people reluctant to work in big firms. The few, who will dare to be creative, will be given a large array of opportunities for success. These will also hopefully be the pioneers to show the pathway to many more.’’

Valentina Di Milla, WBAF’s International Partner for Italy & CEO of the RALIAN Research & Consultancy says ‘’ The post-pandemic Italian economic scenario is characterized by a weak recovery. The industrial sector, because the lockdown has recorded a collapse. However, starting from the re-openings on May 3rd, it is partially rising and recovering, recording an encouraging 45,4%. The services sector data, which are still very low, amounted to 28.9%, not as encouraging. The basic problem is the lack of stimulus from the demand that determines accumulations of stocks and resistance to the momentum by entrepreneurs. The production shock of the deepest consistency is undoubtedly that suffered by sectors such as rubber and plastic, automotive, and the textile and clothing sector. Overall, the entire production sector recorded a drop of 19.1% (data referring to April. In March the recorded shock was 28.4%). This translates into an ascertained reduction in GDP of -5.3% in the first quarter of 2020, while estimates for the second quarter are around -9%. A first ascent will be foreseeable only starting from the third one which, however, will not lead to positive GDP values, but will allow at least to positively distance itself from the minimum point reached in the second quarter. Our government has developed liquidity injection measures to be disbursed through the banking system and through the use of social security mechanisms capable of containing employment and social shocks. However, the efforts made may not be sufficient to contain the economic crisis which in two or three months could lead to the closure of many companies that do not have the necessary liquidity. In contrast, the credit market sees an increase in the use of loans with an interest rate at 1.1%, The disbursement of these loans, which through the support measures put in place by the Government find the guarantee of the State, has allowed companies to breathe and to be able to reopen after the stop of the previous months.’’

Valentina Di Milla, WBAF’s International Partner for Italy & CEO of the RALIAN Research & Consultancy says ‘’ The post-pandemic Italian economic scenario is characterized by a weak recovery. The industrial sector, because the lockdown has recorded a collapse. However, starting from the re-openings on May 3rd, it is partially rising and recovering, recording an encouraging 45,4%. The services sector data, which are still very low, amounted to 28.9%, not as encouraging. The basic problem is the lack of stimulus from the demand that determines accumulations of stocks and resistance to the momentum by entrepreneurs. The production shock of the deepest consistency is undoubtedly that suffered by sectors such as rubber and plastic, automotive, and the textile and clothing sector. Overall, the entire production sector recorded a drop of 19.1% (data referring to April. In March the recorded shock was 28.4%). This translates into an ascertained reduction in GDP of -5.3% in the first quarter of 2020, while estimates for the second quarter are around -9%. A first ascent will be foreseeable only starting from the third one which, however, will not lead to positive GDP values, but will allow at least to positively distance itself from the minimum point reached in the second quarter. Our government has developed liquidity injection measures to be disbursed through the banking system and through the use of social security mechanisms capable of containing employment and social shocks. However, the efforts made may not be sufficient to contain the economic crisis which in two or three months could lead to the closure of many companies that do not have the necessary liquidity. In contrast, the credit market sees an increase in the use of loans with an interest rate at 1.1%, The disbursement of these loans, which through the support measures put in place by the Government find the guarantee of the State, has allowed companies to breathe and to be able to reopen after the stop of the previous months.’’

Miguel Martin, WBAF’s High Commissioner to Spain & founder of the INNPPACT Impact Public-Private Innovation says ‘’ Looking at the recent situation of the COVID 19 pandemic, unfortunately, Spain is globally one of the most affected countries. According to WHO data, at the end of June, Spain has 301 active and 248,000 accumulated cases and between 28.000 to 45,000 deaths depending on different data sources. Geographically, Madrid & Barcelona/Catalonia have been the most affected areas with almost 50% of cases vs 33% of the population. Whilst other regions such as Canary & Balearic Islands, Murcia, Galicia and Andalucia were much less affected till now.

Miguel Martin, WBAF’s High Commissioner to Spain & founder of the INNPPACT Impact Public-Private Innovation says ‘’ Looking at the recent situation of the COVID 19 pandemic, unfortunately, Spain is globally one of the most affected countries. According to WHO data, at the end of June, Spain has 301 active and 248,000 accumulated cases and between 28.000 to 45,000 deaths depending on different data sources. Geographically, Madrid & Barcelona/Catalonia have been the most affected areas with almost 50% of cases vs 33% of the population. Whilst other regions such as Canary & Balearic Islands, Murcia, Galicia and Andalucia were much less affected till now.

The COVID impact on the Spanish economy is already significant. The GDP forecast for 2020 ranges from -9% (Government) to -14% (OECD). An important recovery is expected during 2021 and pre-COVID economic levels should be achieved in 2022 according to the Spanish Government. The tourism & automotive industry are two of the most important pillars of the Spanish economy and are heavily affected by COVID influencing the pace of recovery. Other sectors such as agri-food, health & pharma, logistics, energy, ICT or digitally-based businesses are doing well and finding opportunities due to new COVID-related demands and” new normal” work & life-style.

National Government is developing a recovery plan and meanwhile has announced several measures for SMEs:

● Possibility to defer tax payments for SMEs and freelancers.

● Possibility to postpone payments of loans granted by the Ministry of Industry.

● Loans & liquidity lines for companies in most affected sectors provided by ICO public-lender.

● Special COVID funding lines for R&D initiatives provided by CDTI & “Carlos III” Health Institute.

Additionally, regional governments & municipalities are developing support measures for SMEs & freelancers. At the moment none of the measures respond to the specific needs of startups, angels investors and/or other key players of the entrepreneurship & innovation ecosystems but it seems startups helplines are under development.

Focusing on the Spanish startups’ ecosystem, a recent survey from WAYRA-Telefonica revealed that 74% of the startups are being negatively affected by the COVID, 54% are actively looking for funding and 20% could not survive if the crisis lasts longer than 3 months. The positive side of the survey shows is for Edtech, Fintech, eHealth & Telecommunications startups which are having strong growth & investors’ interest. Furthermore, 85% of startups successfully implemented remote-work, 72% are thinking to maintain or increase their teams, 59% are launching new Corporate Social Responsibility initiatives and 57% of startups look to the future with optimism.

Innovators, entrepreneurs, startups, and digitally-focused companies should become one of the key players speeding-up economic recovery & generating significant amounts of employment adapted to the new needs & roles – remote, hybrid & in-person – demanded by the emerging post-COVID world & new low-touch economy.’’